Share and Save!

Each person who you share your referral code with will receive in credit once they order, while your account will receive .

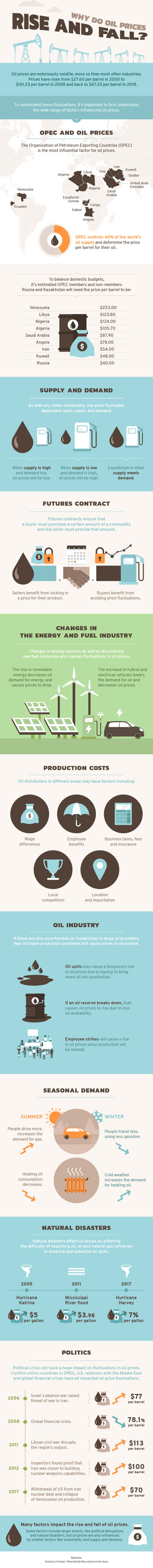

Why Do Oil Prices Rise and Fall?

Knowing what influences heating oil prices can be one of your best ways to plan a winter budget that keeps your home happy and warm. Heating oil seems like a simple system on the surface, but there are many local and international forces at play when it comes to setting the price you pay. You’ll have to consider what drives crude oil prices and factors affecting demand and supply of oil prices to understand the pricing you’ll end up paying to heat your home.

Oil prices are always changing. Consumers do not always know what to expect when they pull up to the gas pump to fuel their vehicles or when they need to order heating oil for their homes. For example, during the winter season of 2008, the price of heating oil hovered between $3 and $4 a gallon. In 2016, heating oil prices were closer to $2 a gallon during the winter months. With prices constantly fluctuating, it can be a challenge to make financial plans.

Despite oil price fluctuations, oil is an important part of our lives. Although we only consume a small amount of crude oil in the United States every day, petroleum products like gasoline and heating oil keep the country running. In 2017, the United States consumed about 19 million barrels of petroleum products each day, or about seven billion barrels a year.

All Americans are affected by oil in one way or the other, yet many do not understand how oil prices change. The economics of oil prices is a complex subject because many different factors contribute to price fluctuations. In this post, we'll explore the top oil price factors to provide a clear understanding of how the pricing process works. With greater knowledge of oil price information, you'll feel more in control when it's time to make an oil purchase.

Want to see oil prices in your state?

Check Live pricing for the following states below:

What Affects Oil Prices?

Oil is a commodity, meaning it is a raw material that can be bought and sold. Examples of commodities include oil, corn and gold. Commodities are commonly sold through legal agreements known as futures contracts.

Buyers purchase futures contracts to lock in prices when they are low. This way, they save themselves from the possibility of higher prices in the future. Sellers of commodities, like farmers, benefit from futures contracts because it removes the risk of price fluctuations for them as well. Commodities must meet uniform standards. For example, if a buyer purchases corn, they will receive the same quality of corn no matter who produces the corn.

In general, commodities are products we need. Imagine how life would be without oil, for example. How would you get to work on time or run your business? Because we need commodities, we are willing to pay for them even when their prices go up. Here are common reasons oil prices rise and fall, so you know what to expect when the seasons change or if tension builds between major oil-producing countries.

2. Crude Oil Costs

Crude oil pricing is often what influences heating oil prices the most. When looking at heating oil prices from the 2004-‘05 winter to the winter of 2013-‘14, crude oil represented 58% of the cost of each gallon of home heating oil. Distribution and marketing followed at 26% of the cost, and refining costs and profits accounted for the final 16%.Crude oil is a global commodity, so what drives crude oil prices tends to be large events or supplies that are large enough to be cost-effective when sent anywhere in the world. The crude oil market is very dynamic, and many forces compete to drive its cost up and down.

Factors influencing crude oil prices include:

- Current supply and output. Until recent years, Organization of Petroleum Exporting Countries (OPEC) often set supply through a quota system. However, American shale oil production doubled between 2011 and 2014, driving down the price. OPEC’s response has been to increase supply and drive down the cost per barrel, which is cutting into the affordability of U.S. shale production. All of this means you’re likely going to see lower home heating oil prices relative to the late 2000s.

- Future supply and reserves. Large oil-producing and oil-consuming countries tend to have reserves of crude oil to keep their economies going in the event that oil prices spike. Oil is stockpiled when the price is low and then spread through the economy to keep prices down when the resource becomes scarce. The U.S. has its Strategic Petroleum Reserve that can be tapped easily, while oil-related allies such as Saudi Arabia also have large reserves that can be tapped.

- Demand from major countries. The price of crude oil jumps when there is a larger demand, and that tends to happen at the beginning, middle and end of the year. Winter — covering the beginning and end of years — can see oil prices climbing as consumers demand more oil for heating their homes and businesses. Summer will also drive up oil prices as more Americans take to the roads for vacation.

- Political events and crises. War, natural disasters, political upheaval and new government leaders are all factors influencing crude oil pricing. For example, the “Arab Spring” unrest in 2011 pushed oil prices to a peak of $113 a barrel as unrest and protests rocked Egypt, Libya and Tunisia. They then returned to under $100 per barrel as things calmed down in June. Hurricane Katrina caused a large price increase in 2005 when it destroyed hundreds of oil and gas platforms and pipelines.

3. Supply and Demand

The law of supply and demand is a basic rule in oil economics and a major factor when it comes to price. Demand refers to the amount of a product consumers want and are willing to pay for. Supply refers to how much of a product is available. The relationship between supply and demand affects all commodity prices, including oil. Here are a few examples of how supply and demand work:

- High supply and low demand equals low prices: When the supply of a product increases, the price goes down. When the price goes down, the demand goes up because consumers want to pay a lower price. For example, if a farmer grows more corn than he can sell, he will lower the price to try to get rid of the excess. Once customers realize they can purchase corn at a very low price, they will demand more of it.

- Low supply and high demand equals high prices: When there is too much demand for a product, the supply will run low. When there is not enough of a product to meet the demand, prices increase. When prices increase, the demand eventually decreases because people do not want to pay high prices for the product. Prices will fall once demand goes down. For example, if hundreds of customers all want to purchase the same toy as a holiday gift and there are not many toys available, prices will go up. Once customers no longer want to pay such a high price, the price will decrease.

- Equilibrium as the goal: When equilibrium is reached, the amount of available supplies equals the demand. For example, if a balance is reached between the supply and demand of oil, customers can expect stable gas prices.

Buyers and sellers use the rule of supply and demand to predict how prices might change in the future. For example, if oil prices drop in the winter, buyers might predict a price boost in the summer when people need gasoline to travel. They might buy a futures contract to eliminate the risk of future price changes resulting from supply and demand.

4. Futures and Commodities Traders

Futures are the promise from various companies to buy oil at a set price. This drives the cost up and down for crude oil and has an impact on the amount the consumer pays at the pump and for electricity.

Futures allow buyers to lock in a price, which prevents large price fluctuations from affecting them. At the same time, sellers benefit from a futures contract because they lock in the price of their product. Even if the price falls, they have the contract in hand and an assurance of a certain amount of income.

Simply put, commodities traders determine the price of oil by bidding on futures contracts in the commodities market. Oil prices can change depending on what happened in the market that day. Traders consider three main factors when creating bids that determine oil prices. Those are:

- Current supply: The United States is growing as a crude oil producer thanks to shale oil production. For example, in 2015, traders were able to bid the oil price down to about $37 a barrel. In response, OPEC allowed their oil prices to fall.

- Future supply: Future supply refers to oil reserves, which could be used if prices get too high.

- Demand: The Energy Information Agency provides monthly estimates to help traders predict demand changes. They'll consider weather and travel forecasts, for example.

The buyer of a futures contract is obligated to purchase a certain commodity when the contract expires and the seller is obligated to provide the commodity at that time.

Oil producers sell their oil using futures contracts so they can lock in a price and when they know they will sell their oil and deliver it at the end of the contract. Buyers use futures contracts to purchase oil at a price they know they are going to pay to avoid price fluctuations. Manufacturers, for example, might use futures contracts because they regularly require oil deliveries and they can rest assured that they will have oil when they need it a price they agreed to pay.

Commodities traders are usually representatives of companies who use oil. They buy oil in advance for delivery in the future to prevent risk to their company. Other traders are speculators who aim to make money from price changes.

The government and OPEC can influence bidders' decisions, but they do not actually set the prices. When oil prices are low, the government can stockpile oil to tap into when prices go up again or to use in emergency situations. America is home to the Strategic Petroleum Reserve (SPR) — the world's largest supply of emergency crude oil.

5. Changes in the Energy Industry

Changes in the energy industry affect prices as well. As more people turn to sustainable options, such as wind or solar power, the demand for oil diminishes. It's estimated that by the year 2022, renewable electricity will grow 40 percent around the world. Another area that limits the need for oil and causes prices to drop is the increase in the availability of hybrid and electric vehicles.

OPEC keeps tight control of the price of oil because if they raise prices too high, then people will begin to seek out alternative fuel sources in earnest, which could impact them long term as fewer people use oil as their fuel source. On the other hand, if they lower their prices too much, then it's difficult to cover costs while still making a profit.

6. Seasonal Demands

Seasonal changes greatly influence crude oil prices. For example, prices tend to rise in August when people travel and demand gasoline. Also, hurricane season peaks between August and September, driving up oil prices. It is also worth noting that, in the summer, refineries switch to summer-blend gasoline production, which is more expensive to make than winter-blend. The Clean Air Act requires that different fuel is used for different seasons. In the winter, cars use a blend which allows them to start in colder weather. However, winter-blend gasoline would release more emissions if used in the summer. Summer-blends cost more to produce and it is estimated they add three to 15 cents per gallon of fuel.

Crude oil prices often fall in October and they hit bottom in December. However, home heating oil prices tend to go up in the winter to meet the demand. Sometimes, in the winter, it is hard for refineries to keep up with the demand for home heating oil, causing an increase in price. Some people worry supplies will run out, so they stockpile oil. Nevertheless, other factors, like politics, can make a greater impact on prices than weather changes.

7. The Weather

One of the most consistent factors influencing the cost of your heating oil is the weather. In the U.S., prices are typically driven by homes in the Northeast, so they can be a good barometer for your oil pricing. When the winter is warm, the price of heating oil holds near its price during the rest of the year. The colder the weather, the higher you can typically expect heating oil prices to rise. A colder winter can cause a significant increase in consumer use of heating oil, which can push prices up.

An important part of the weather is major storm systems that move throughout the U.S.:

- When a large storm hits, it usually brings lower temperatures and increases the heating demand of each home.

- Storms also make it harder to get heating oil to your home.

- When roads are blocked, trees fall or large snows make it difficult for trucks to move throughout your neighborhood and city, heating oil companies need to spend more money on the equipment and talent required to get heating oil to your home.

Sometimes this also means home heating oil suppliers can risk running out, and that’s one of the toughest factors that affect oil prices. If suppliers can’t meet all of the demand in your area, then prices will rise and your company may need to start bidding higher to get the heating oil you need.

The U.S. Energy Information Administration notes that the Northeast U.S. will often have to turn to the Gulf Coast or Europe if it faces a heating oil shortage. Delivery from these sources can take weeks and will have to travel across harsh regions, increasing the cost compared to shipments earlier in the year.

8. Natural Disasters and Politics

Natural disasters can cause crude oil prices to fluctuate by affecting the oil supply. For example, in August of 2017, U.S. oil refineries shut down to prepare for Hurricane Harvey, causing gas prices to rise almost 10%. If pipelines are destroyed or damaged, oil distribution slows down, repairs need to be made and prices temporarily spike.

Hurricane Katrina, which slammed the Gulf of Mexico in 2005, damaged U.S. pipelines and oil platforms along the coast, causing oil prices to temporarily rise above $70 a barrel. President Bush tapped into the SPR to help refineries get back into operation and get prices back down.

Politics can make a strong impact on oil prices as well. For example, in 2013, the cost of crude oil went up to over $115 a barrel because traders bid up the price of oil after the U.S. announced they would use air strikes on Syria. Although Syria is not a major source of oil, traders worried how an air strike would affect other oil-producing countries, including Iran.

Another example was the Arab Spring, a series of political uprisings, that drove oil prices up in 2011. Oil prices rose to almost $120 a barrel because traders feared they would not be getting oil from Libya, an OPEC country, for a while.

There are plenty of examples where political matters have caused a disturbance in oil production and affected prices. Many Americans remember the 1973 Oil Embargo, when OPEC members imposed an embargo, or ban on trade, on the United States for re-supplying the Israeli military. Oil barrel prices first doubled and then quadrupled, and soon there was a gas shortage.

In general, traders worry war will limit oil supply. When traders are afraid they'll lose oil, they are willing to pay a higher price.

9. Your Neighborhood

Your next-door neighbors and local cities can also play a role in the cost you’ll pay for your home heating oil.

In the U.S., the Northeast accounts for roughly 87% of all residential fuel oil sales, and that is expected to stay relatively stable because most new homes are turning to natural gas and electricity for their heating systems. The Midwest is the second-largest area but it only accounts for 6% of all sales, followed by the South at 4% and the West at 3%.

Heating oil is a commodity, so it has many pricing factors affecting demand and supply of oil. Some of the biggest considerations for you include the number of dealers and suppliers that you have access to, plus how easy it is for companies to get to you. The easier it is for you to access heating oil from multiple companies, the more they’ll need to compete on price to win your business.

On the other hand, if you live in an area only serviced by one supplier or if your home is especially hard to get to, you can expect to pay more than the national average for your heating oil.

Where you live will also play a role in your heating oil costs:

- How close you live to a refinery or a fuel staging and supply area, such as the New York Harbor, influences what heating oil prices are.

- Here in the U.S., you should look at refineries both foreign and domestic.

- Many homes in the Northeast are close to refineries and supply depots in Canada and have quick access to pipelines, rail lines and roads used by oil production companies.

- Refineries in the Gulf Coast also supply a large set of heating oil when it is in demand. Refiners face some limitations based on size and storage capabilities, which means a local outfit might not be able to keep up with your needs throughout the year.

When refineries create heating oil, they also create other petroleum-based products. Each company will balance its production based on its ability to sell all of those products, not just the heating oil, and some products experience demand drops in the winter. It’s not just how close you are to any refinery, but how close you are to a refinery that can actively produce and sell heating oil plus its other products.

And the last factor for where you live is actually the homes in your neighborhood. Newer houses and those in more expensive neighborhoods may be more energy efficient homes with new, better insulation. These advances can drive down local demand in heat oil.

Some projections show a 20% decline in homes using heating oil from 2006 to 2013, and further 3% decline by the end of 2014. Energy-efficient upgrades to homes and appliances are thought to be the main cause for this decline.

10. Extra Factors: Pricing Surges

Heating oil sometimes experiences a temporary surge in price when many different factors change all at once or when common price factors take sudden turns.

Rapid temperature changes, such as early snows or large storms, are a common reason for a surge in heating oil pricing at the beginning of the winter season. Demand increases ahead of the supply, so companies scramble to get oil out to all of their customers as trucks and trains slowly cross frozen delivery areas.

Prices may surge high and then continue to rise over the following weeks as smaller companies run out of their supply and end up paying more for refineries and distributors to deliver to their company first. Wholesale buyers are among the first to increase their bids when shortfalls are projected, and that increase is passed through the entire chain until it reaches homeowners like you.

Moving into the winter during times of political unrest and war in oil-producing countries can cause uncertainty for refineries and other production systems, which means companies may increase the cost of heating oil in expectation that shortages will happen soon.

The big thing for consumers to watch each winter is what OPEC plans to do next. OPEC plays a significant role in keeping costs low or high by managing their production quotas. While shale oil production has removed much of OPEC’s power above certain price points, shifts in its trade practices always have a potential to scare the market and increase prices in a short time span.

In general, heating oil prices fluctuate a small amount and make slow changes, but severe weather and supply shortages can always cause large, quick adjustments in what you’ll end up paying next week.

Check Prices at Smart Touch Energy

It’s difficult to predict the rise and fall of oil costs. When prices are low, stock up as much as you can and when they are high you’ll have a buffer in place to see you through. As long as everything runs smoothly, prices rarely fluctuate outside of a 30 to 50 cent range. However, any number of factors can impact the cost and drive prices up unexpectedly.

Although you can't control natural disasters or political tension, you can control how much you choose to pay for heating oil. At Smart Touch Energy, we put the power in your hands to find the lowest local prices. To get started, all you need to do is:

- Enter your zip code

- Check for service availability and the best pricing in the area

- Choose your delivery options

- Place your order and expect delivery within three business days

Although it might seem unrelated at times, the fact remains: crude oil prices impact home heating oil. Heating oil prices fluctuate for various reasons, including:

- Seasonal demands: Home heating oil prices typically go up during the winter months. Someone who lives in the Northeast might use up to 1,200 gallons of oil during the winter.

- Crude oil price changes: When disaster strikes or war breaks out in other countries, crude oil prices are impacted. When crude oil goes up, so does the price of heating oil.

- Local competition: The number of heating oil suppliers in an area can affect the cost of heating oil. For example, if there are many different suppliers in one area, chances are good prices will be lower than a location with few suppliers. Companies will compete with each other and offer the best prices to make customers happy. In rural areas, customers might pay more for heating oil if less competition is around.

- Regional operating costs: Costs vary greatly depending on the part of the country the oil is being delivered to. For example, it might cost more to deliver oil to a remote location than to a heavily populated area. Some parts of the country get oil from other parts of the world, which can cost more.

Smart Touch Energy offers heating oil services in the Northeast, serving Maryland, New Jersey, Massachusetts, Connecticut, New York, Pennsylvania, Rhode Island, New Hampshire, Maine and Delaware. We buy oil when prices are low, allowing our customer to enjoy unbeatable savings. Our online ordering system makes fuel delivery fast, easy and affordable.

We believe heating oil and a delivery service you can depend on shouldn't cost a fortune. To check heating oil prices, sign up for an account and start enjoying the benefits of Smart Touch Energy today!

Saudi Arabia is OPEC's largest oil producer and the world's largest oil exporter. OPEC makes decisions based on current supply and demand and also considers future expectations.

According to 2016 estimates, 81.5% of the world's crude oil reserves are located in OPEC countries. OPEC does not decide how much oil costs but can influence prices by controlling oil production. They aim to set production to meet global demand, but if they increase or decrease oil production levels, they can affect the price of oil. Generally, when production goes down, prices go up.

OPEC's mission is to provide stability within the oil market by establishing uniform policies, regularly supplying petroleum to consumers and ensuring producers receive a fair income. In short, OPEC helps bring order to the oil market. OPEC was formed by five oil-producing countries in the 1960s.

- Congo

- Angola

- Ecuador

- Kuwait

- Equatorial Guinea

- Algeria

- Iran

- Nigeria

- Saudi Arabia

- Libya

- Qatar

- United Arab Emirates

- Venezuela

- Iraq

- Gabon

The Organization of Petroleum Exporting Countries (OPEC) influences oil price fluctuations more than any other factor on this list. The organization is made up of 15 member countries, which are: